Price Drives Sentiment

August 30, 2024

Without data, you're just another person with an opinion.

—W. Edwards Deming

From July 16 to August 5, the S&P 500 experienced a decline of 8.5%, culminating in a sharp 3% drop on August 5. During this period, headlines, clients, and pundits alike were quick to declare the end of the bull market. Market shocks often bring out the naysayers, ready to predict prolonged downturns. As we often say, “Price drives sentiment.” Yet, by the end of August, the volatility was largely forgotten, and the purported reasons behind it faded into the background.

When prices fall, emotions inevitably come into play. Fear, greed, and other feelings can drive investors to act impulsively, often to the detriment of their long-term goals. While much has been written about investor psychology, we want to focus on a different concept in this Investment Update: the importance of speed and timeframe in responding to market changes.

Every investor operates within a unique timeframe aligned with their personal goals, and each has a choice in how quickly to react to market movements. Rather than making a binary decision — being “in” or “out” — we encourage clients to think of their reactions as being on a continuum of speeds. Just as you would respond to the first signs of smoke differently than dancing flames, we think it’s crucial to begin adjusting exposure when early warning signs appear. This approach allows for timely, incremental adjustments without overreacting to initial market fluctuations.

In this month’s Investment Update, we review the market volatility of July and August and discuss how our strategies responded. In this instance, waiting for a persistent trend before taking action proved beneficial. However, it’s important to remember that this won’t always be the case. The key lies in steadfastly adhering to your process, particularly during emotionally charged environments. Over time, consistent discipline in your approach will naturally lead to favorable outcomes, in our view.

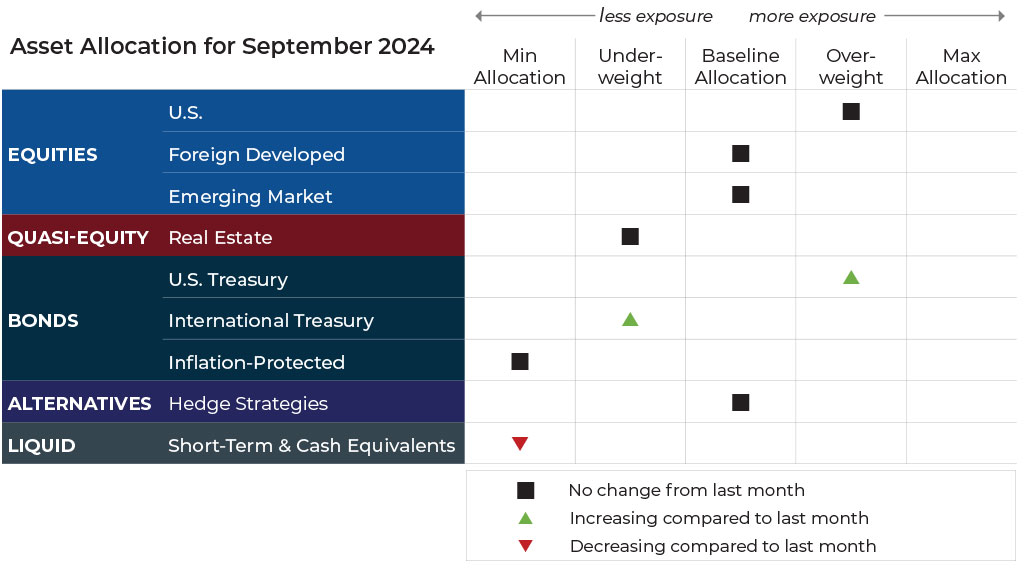

But first, here’s a summary of the global asset classes utilized in our portfolios and their exposures for September.

Sourcing for this section: Barchart.com, S&P 500 Index ($SPX), 7/16/2024 to 8/5/2024

Asset Allocation Update

Source: Blueprint Investment Partners

Adjustments can vary across strategies depending on each strategy's objectives. What's illustrated above most closely reflects allocation adjustments for the Growth Strategy. Diversification does not guarantee investment returns and does not eliminate the risk of loss. Diversification among investment options and asset classes may help to reduce overall volatility.

U.S. Equities

Exposure will not change and remain overweight. Trends over all timeframes are positive, and it remains the strongest equity asset class over the long term.

International Equities

Exposure will not change and will stay at the baseline allocation. Trends are positive across all timeframes.

Real Estate

Exposure will not change and remain underweight due to its long-term weakness relative to U.S. equities.

U.S. & International Treasuries

Exposure will again increase as trends improve and the asset strengthens. U.S. Treasuries will move to overweight. International Treasuries will remain underweight due to long-term weakness.

Inflation-Protected Bonds

Exposure will not change and will remain at its minimum.

Alternatives

Short-Term Fixed Income

Exposure will decrease, hovering around minimum levels, since allocations will be returned to higher-duration U.S. Treasuries.

Asset-Level Overview

Equities & Real Estate

After a sharp drop to open August, the S&P 500 Index quickly recovered to challenge new all-time highs as the month closed. Tech and growth continued to lead the pack for the year, as they have for much of the uptrend since the start of 2023. All segments and factors remain in uptrends and as a result, our portfolios will remain overweight U.S. equities, particularly large- and mega-cap stocks.

Foreign developed and emerging markets allocations will remain steady heading into September. The two international equity segments are in a virtual deadlock in terms of year-to-date performance, but emerging markets are slightly stronger from a trend perspective.

Real estate securities are on pace to be the best-performing asset class for the second consecutive month, among those we track closely. Naturally, uptrends remain in place as we enter September. However, exposure in our portfolios will continue to be capped due to the long-term weakness of this asset class compared to U.S. equities.

Fixed Income & Alternatives

The biggest changes in portfolios for September will happen within the fixed income segment. With prices reflecting growing confidence in declining rates, values have risen, uptrends have been generated, and strength has increased. As a result, duration in our portfolios has also increased. In fact, for the first time since 2021, ultra-short-duration bonds will decrease in exposure to near-minimum levels. Instead, intermediate- and even long-duration bonds will take significant positions.

For the alternatives allocation in our portfolios, net long equity exposure has decreased slightly but remains the most notable segment. Fixed income has also moved back to the long side and increased. Commodity and currency net exposure remains muted.

Sourcing for this section: Barchart.com, S&P 500 Index ($SPX), 8/1/2024 to 8/27/2024 and Barchart.com, Real Estate Vanguard ETF (VNQ), 7/1/2024 to 8/27/2024

3 Potential Catalysts For Trend Changes

Rate Cutting Expected: Although economic data is mixed, Federal Reserve policymakers are likely to begin cutting rates when they next meet in September. Recent data shows continued inflation cooling, but the labor market has recently indicated weakness. Additionally, a recovery in the housing market has not materialized, even though lower mortgage rates and higher inventory have improved the buyer’s market.

Job Market: The job market has been weaker than previously thought. New data reflecting the period from early 2023 to early 2024 shows employers may have added 818,000 fewer jobs than originally thought during the 12 months that ended in March. That means the economy may have added 68,000 less jobs per month than previously reported.

Mortgage Rates: Mortgage rates fell to a new 15-month low, with the average rate for a standard 30-year fixed mortgage dropping to 6.35% from just under 6.5% a week earlier. Mortgage rates are more than a 1% lower than the near-8% peak they reached in 2023. However, mortgage rates are still about twice what they were before the Federal Reserve started to raise interest rates in 2022.

Sourcing for this section: The Wall Street Journal, “'Soft Landing' Gets a Boost From New Data,” 8/29/2024; The Wall Street Journal, “U.S. Job Market Was Weaker Than Previously Reported, Data Show, 8/21/2024; and The Wall Street Journal, “Mortgage Rates Fall to Lowest Since May 2023,” 8/29/2024

Post-Mortem On August’s Market Shock

You should be far more concerned with your current trajectory than with your current results.

—James Clear

On August 5, the day the S&P 500 opened at the lowest level since early May, we received the following communication from our asset management partner, Blueprint Investment Partners, that I think provides some helpful context:

Hello everyone, in light of this morning’s market action, we wanted to pull together some data to hopefully provide some helpful context. We’ve attached a sheet showing the frequency of various levels of daily decline in the S&P 500 Index (ETF: SPY) over the last 30 years when an uptrend (as marked by the previous day’s 10 day EMA being greater than its 100 day EMA).

The bottom line: daily declines of 2%, 3%, 4%, and even 5% will occur from time to time which means they are intrinsic (not a threat) to the system. For example, prior to today there have been 116 occurrences of a 2% decline in a 10/100 uptrend over the last 30 years. This equates to almost 4 per year. Obviously 3, 4, and 5% declines happen less frequently but they still happen and appear to have little bearing on long-term performance.

…

No one knows what will happen and all declines can be painful, but in our opinion the data is pretty conclusive. We will let the trends play out and make adjustments if necessary at month-end.

If you have any questions don’t hesitate to reach out. Thanks as always for your partnership!

This communication was on the back of a poor performance for U.S. equity markets at the end of July. In fact, in our last Investment Update we discussed the concept of “the anatomy of a bear market,” which dissects the various types of declines we observe in the markets. We concluded the last Investment Update with these questions:

And yet, in 30 days is it so hard to believe that we won’t be making new all-time highs? In April, the justification for decline was economic data indicating persistent inflation that would take rate cuts off the table. That amounted to nothing. Will this time be different? Who knows?

The point of sharing this is not to pound our chest but rather to highlight the benefit of having a system and following it with discipline: We were able to communicate our plan while acting decisively and confidently in the face of an anxiety-inducing situation. We can’t brag about what happened in August because we disregard predictions. Had the market fallen further in August, we would have been no more right or wrong.

The outcome isn’t what matters — but rather the process.

Our systematic investing process and the ensuing ability to communicate clearly helps us to touch base with our clients proactively and boldly. This usually goes a long way in calming nerves and keeping the focus on long-term goals.

The same lessons and benefits apply to what is happening with fixed income. It is reasonable to believe bond prices should recover as the Fed embarks on its next rate-cutting cycle, but when will they recover and how fast? As we said above, “Who knows?”

All we know is our systematic investing process is recommending a big change to how we have been exposed to bonds for the last couple of years. Ultra-short-duration bonds have been a major portion of our portfolios for this period of time, but this allocation will now be placed on the backburner. It takes conviction or a system — and maybe both — to enact such a big shift.

As we constantly repeat, for us there is tremendous comfort and confidence in having a rules-based, data-centric approach. We don’t know what will happen, but we know exactly what we will do depending on what DOES happen (or is happening). Is it perfect? No, but it definitely beats the alternative, in our opinion.

Sourcing for this section: Barchart.com, S&P 500 Index ($SPX), 5/1/2024 to 8/27/2024

Let's Talk

If you have any questions about what transpired in the markets last month or portfolio positioning for the month ahead