News & Investment Updates From Ribbon Falls Wealth Management

Investment Update

Investment Systems Can Do Almost Anything. But Not Everything.

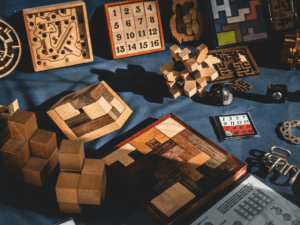

One of the biggest misconceptions in investing is that the best system is the one that does everything. In reality, the strongest systems are those that do a few things well — and intentionally avoid the rest.

At Ribbon Falls Wealth Management, we believe the art of system design lies not in complexity, but in clarity and robustness. That means focusing on what works across a variety of market environments, not just what works in backtests or ideal conditions. It also means making tough decisions about what to prioritize — and being honest about the tradeoffs. Responsiveness might improve timing but increase taxes. Broader exposure might boost diversification but dilute conviction. There’s no free lunch.

Like all investment strategies, trend following comes with tradeoffs. But unlike many approaches that try to mask them, it brings those tradeoffs to the surface — where they can be understood, managed, and ultimately turned into strengths.

In this month’s Note, we explore how trend following, like life, requires choices. We also share how the current environment continues to highlight the importance of staying focused on what works — rather than trying to be everything at every time to everyone.

But first, here’s a summary of the global asset classes utilized in our portfolios and their exposures for June.

Investment Update

Simplicity Is a Good Defense Against Uncertainty

In investing, uncertainty isn’t a bug — it’s a feature.

No matter how much data we gather or how many historical patterns we study, markets have a way of surprising even the most seasoned observers. The challenge isn’t in predicting these surprises; it’s in expecting and preparing for them.

At Ribbon Falls Wealth Management, we believe the best defense against uncertainty isn’t complexity, but simplicity. Rather than layering on endless rules to account for every possible market twist, we focus on the few relationships that have demonstrated durability over time. One of the most reliable patterns we observe is the clustering of volatility — the idea that extreme moves, both up and down, often come in waves.

April provided a vivid reminder of this phenomenon, as sharp declines and dramatic rallies unfolded within days of each other. Moments like these reinforce why our systematic investing approach emphasizes trend direction, not short-term prediction. It’s not about avoiding every bump; it’s about consistently adapting to the environment, reducing risk when conditions warrant, and positioning for long-term compounding.

In this Investment Update, we explore how April’s market behavior illustrated the power — and necessity — of simplicity, discipline, and flexibility in portfolio management.

But first, here’s a summary of the global asset classes utilized in our portfolios and their exposures for May.

Archive: News & Investment Updates

Investment Update

Downturns May Look Similar, But Context Tells Us When To Act Different

Investment Update

A Disciplined Strategy Helps Avoid Self-Inflicted Wounds

Let's Talk

To discuss how we can help build your financial roadmap